Saving for future goals like retirement is important to employees. For employers, offering a strong benefits package is a necessity when it comes to recruiting and retaining quality employees. Partnering with a retirement plan provider that understands an employer’s needs and budget and can also deliver a quality retirement plan benefit for your employees is a rarity.

Don’t have employees? We have an innovative new solution designed for the unique needs of independent contractors and other solo operators. Click here to learn more about the Access Solo PEP.

Whether it’s the rigid plan design options, high fees, legal risks, conflicts of interest or administrative and compliance hassles, employers face a wide variety of challenges when it comes to offering a retirement plan.

With Access Retirement Solutions’ proprietary PEP model, employers get a flexible plan design with a streamlined service that greatly reduces the challenges and headaches of offering a 401(k) retirement plan while keeping employees’ end goals at the forefront.

Employers reap the benefits of a larger plan while reducing the costs and risks of a single employer plan (or pooled arrangement). As a complete retirement plan solution provider, Access helps keep employers focused on their business.

The Access PEP 401(k) retirement plan model removes conflicts of interest that are inherent in most PEP provider’s models and places employers’ and their employees’ best interests at the epicenter:

Access PEPs are focused on reducing employers’ legal risks and administrative burdens

Routine Amendments are addressed by the PEP, rather than by each Employer Group

Merger and Acquisition activity no longer requires termination or transition headaches

Potential for fiduciary litigation is all but eliminated

No more Form 5500s

No more Quarterly Committee Meetings

Investment offerings available through the Access PEPs are selected and rigorously monitored and Access assumes complete discretionary responsibility for the investment lineup. This unconflicted approach ensures ongoing monitoring of the available investment offerings and that the fees remain reasonable.

Access strives to select best-in-class investment alternatives to provide a wide array of options. By removing the conflicts of interest, Access is not limited to a predetermined universe of offerings. As a result, participants are not limited to “Brand X” or proprietary offerings. Instead, each investment is selected based upon objective criteria. Plus, with this transparent pricing, there is no need to use less efficient share classes. This approach results in an investment menu comprised of a variety of options that are carefully selected based upon both their performance and cost. Participants are able to select from various low-cost index funds, actively managed funds or simply set it and forget it by selecting or defaulting into one of the PEPs’ target date funds, which serve as the qualified default investment alternative.

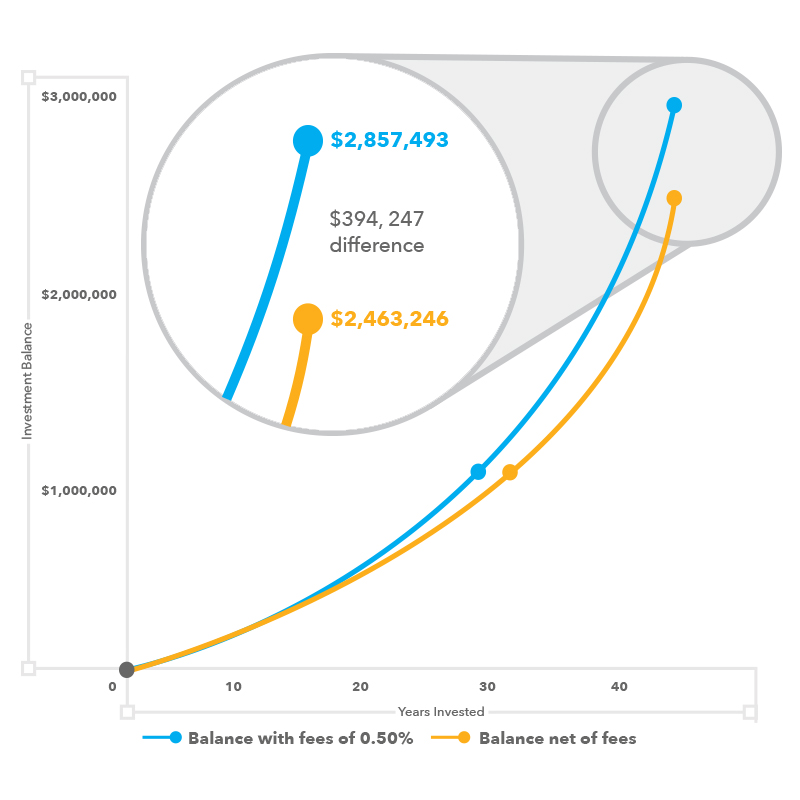

Plan costs like recordkeeping administrative and investment fees can add up over time. If left unchecked, they can take a toll on each employee’s retirement savings.

What could you do with an additional $400,000 in your retirement? This difference saved in plan costs could potentially pay for a retirement home, pay down debt, cover healthcare costs or help boost savings for dream vacations.

We keep employees’ goals at the forefront. That’s just one of the reasons Access does not charge the PEPs or the participants additional investment fees.

Access Retirement Solutions was founded in 2020 by Heath Miller and Michael Halloran with a sole focus on delivering affordable, best-in-class retirement plan solutions to employers and empowering employees to achieve financial security. Access Retirement Solutions understands the concerns that come along with offering retirement plans – high fees, hidden costs, legal risk, administrative headaches and conflicts of interests – to name a few.

When the SECURE Act passed in December 2019, they wanted to take action – providing access to a meaningful retirement plan benefit to employers of all sizes designed to meet their unique needs in a simple, low-cost, transparent approach.

Gone are the days when employers lacked options when it came to providing quality retirement plan benefits to their employees – now there’s ACCESS.

@ 2024 by Access Retirement Solutions.

All advisory services offered through Access Fiduciary Services, LLC a Massachusetts registered investment advisor. Access Retirement Solutions sells subscriptions to the Access PEP that is sponsored by Access Plans, LLC an affiliated entity. Access Plans, LLC has designated Access Fiduciary Services, LLC as the plan fiduciary responsible for providing investment advisory services to the Access PEP. Access Fiduciary Services is an affiliated entity of Access Retirement Solutions and Access Plans, LLC. Employers who enroll in the Access PEP will have no discretion to designate the Plan Sponsor or Fiduciary.

Access Retirement Plans, LLC nor its affiliates receive any compensation from the Access PEP. All compensation for services provided to the Access PEP are charged on a subscription basis to the participating employer.