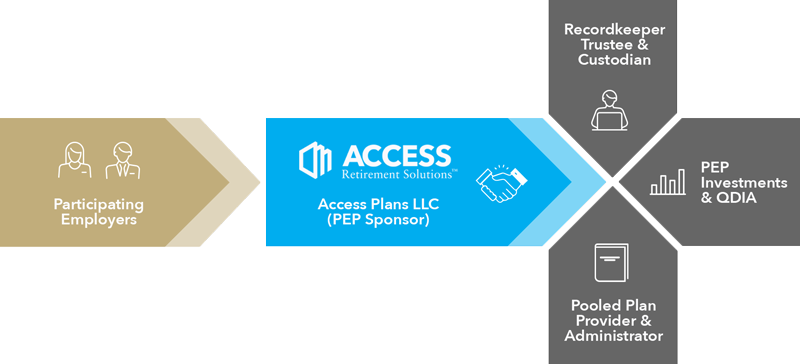

The SECURE Act, which became effective on January 1, 2021, allows unrelated employers to offer retirement benefits to their employees through newly created arrangements called Pooled Employer Plans (PEPs). Access Retirement Solutions (Access) saw a unique opportunity to improve upon the PEP model and developed a proprietary retirement plan solution with a sole focus on delivering affordable, best-in-class retirement plan solutions to employers and empowering employees to achieve financial security.

The Access team is led by industry experts with nearly four decades of combined experience. They’ve partnered with some of the best in the industry to deliver a meaningful retirement plan benefit to employers of all sizes designed to meet their unique needs in a simple, low-cost, transparent approach.

Gone are the days when employers lacked options for providing quality retirement plan benefits to their employees – now there’s ACCESS.

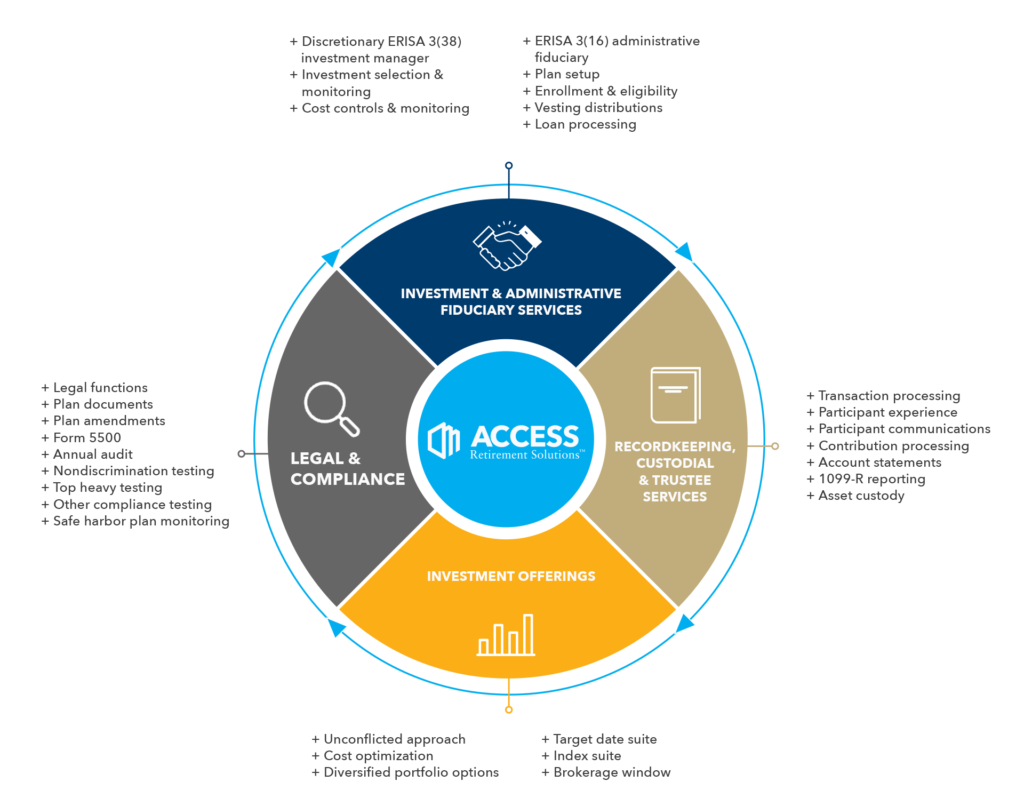

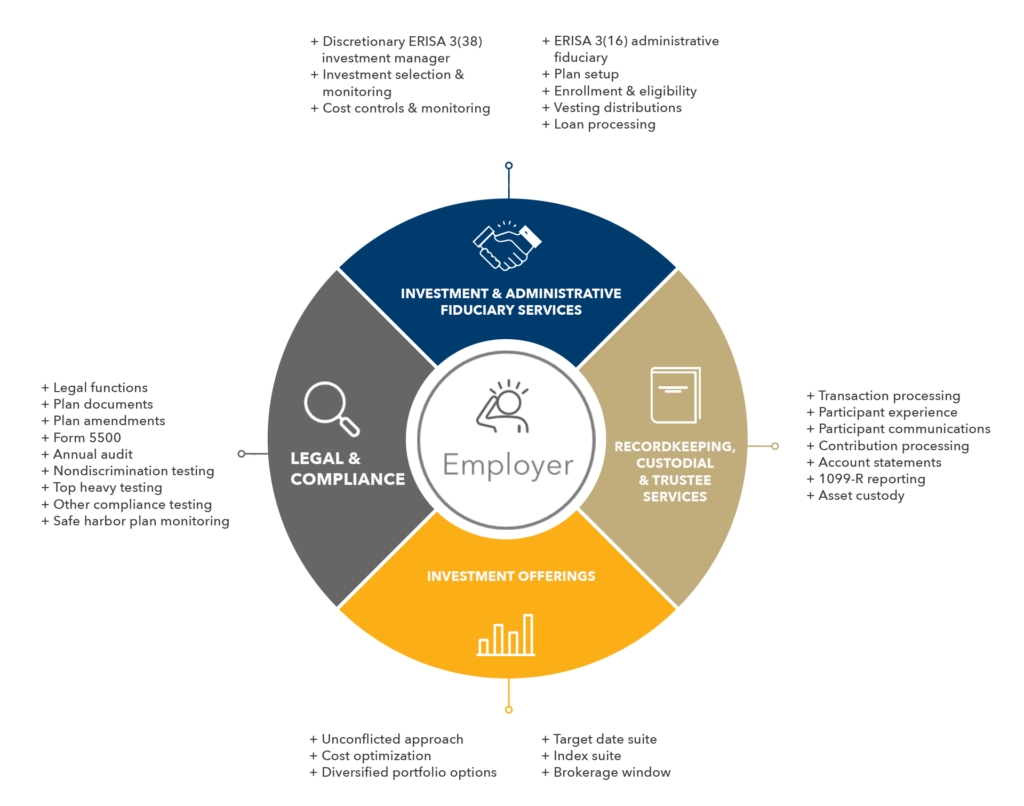

Access provides a series of simple low-cost 401(k) retirement plan PEPs in an unconflicted structure designed to dramatically improve efficiency and reduce administrative and investment costs.

As a complete retirement solution provider, Access provides employers with one point of contact and removes the headaches of offering a 401(k) retirement plan benefit.

We handle it all with a cost efficient, transparent model:

Access Retirement Solutions was founded in 2020 by Heath Miller and Michael Halloran with a sole focus on delivering affordable, best-in-class retirement plan solutions to employers and empowering employees to achieve financial security. Access Retirement Solutions understands the concerns that come along with offering retirement plans – high fees, hidden costs, legal risk, administrative headaches and conflicts of interests – to name a few.

When the SECURE Act passed in December 2019, they wanted to take action – providing access to a meaningful retirement plan benefit to employers of all sizes designed to meet their unique needs in a simple, low-cost, transparent approach.

Gone are the days when employers lacked options when it came to providing quality retirement plan benefits to their employees – now there’s ACCESS.

@ 2024 by Access Retirement Solutions.

All advisory services offered through Access Fiduciary Services, LLC a Massachusetts registered investment advisor. Access Retirement Solutions sells subscriptions to the Access PEP that is sponsored by Access Plans, LLC an affiliated entity. Access Plans, LLC has designated Access Fiduciary Services, LLC as the plan fiduciary responsible for providing investment advisory services to the Access PEP. Access Fiduciary Services is an affiliated entity of Access Retirement Solutions and Access Plans, LLC. Employers who enroll in the Access PEP will have no discretion to designate the Plan Sponsor or Fiduciary.

Access Retirement Plans, LLC nor its affiliates receive any compensation from the Access PEP. All compensation for services provided to the Access PEP are charged on a subscription basis to the participating employer.