Flyout Menu

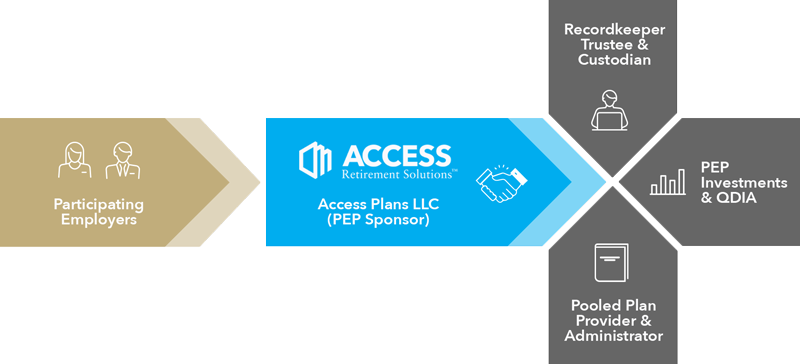

The SECURE Act, which became effective on January 1, 2021, allows unrelated employers to offer retirement benefits to their employees through newly created arrangements called Pooled Employer Plans (PEPs). Access Retirement Solutions (Access) saw a unique opportunity to improve upon the PEP model and developed a proprietary retirement plan solution with a sole focus on delivering affordable, best-in-class retirement plan solutions to employers and empowering employees to achieve financial security.

The Access team is led by industry experts with nearly four decades of combined experience. They’ve partnered with some of the best in the industry to deliver a meaningful retirement plan benefit to employers of all sizes designed to meet their unique needs in a simple, low-cost, transparent approach.

Gone are the days when employers lacked options for providing quality retirement plan benefits to their employees – now there’s ACCESS.

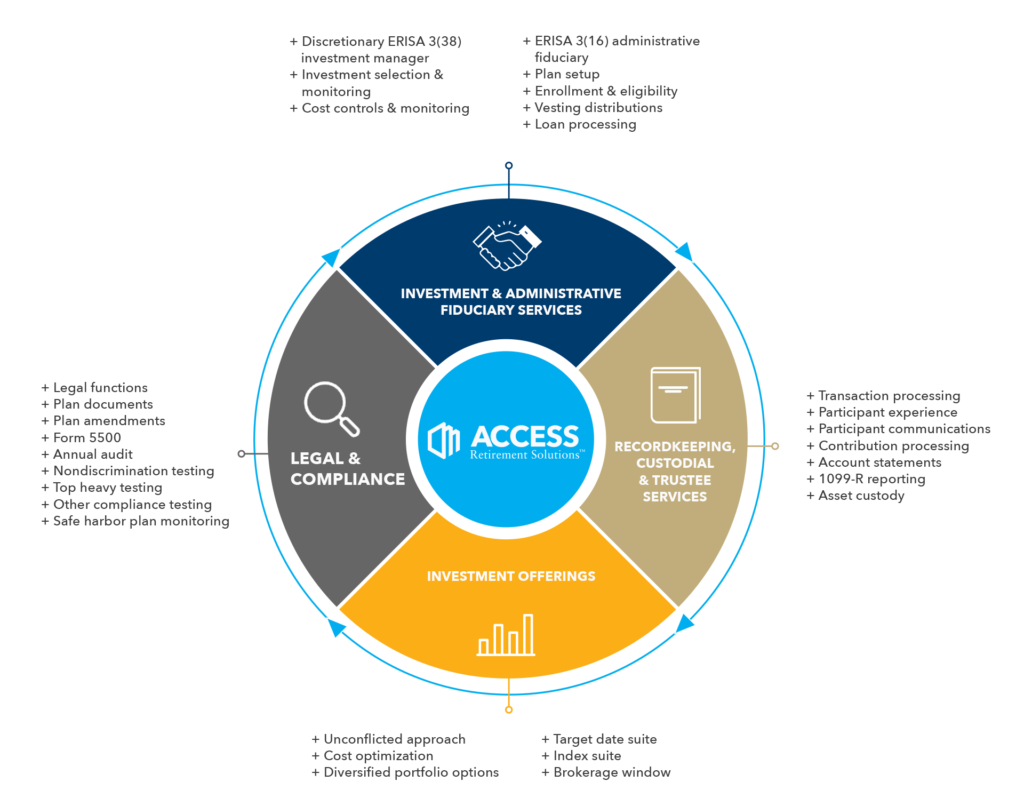

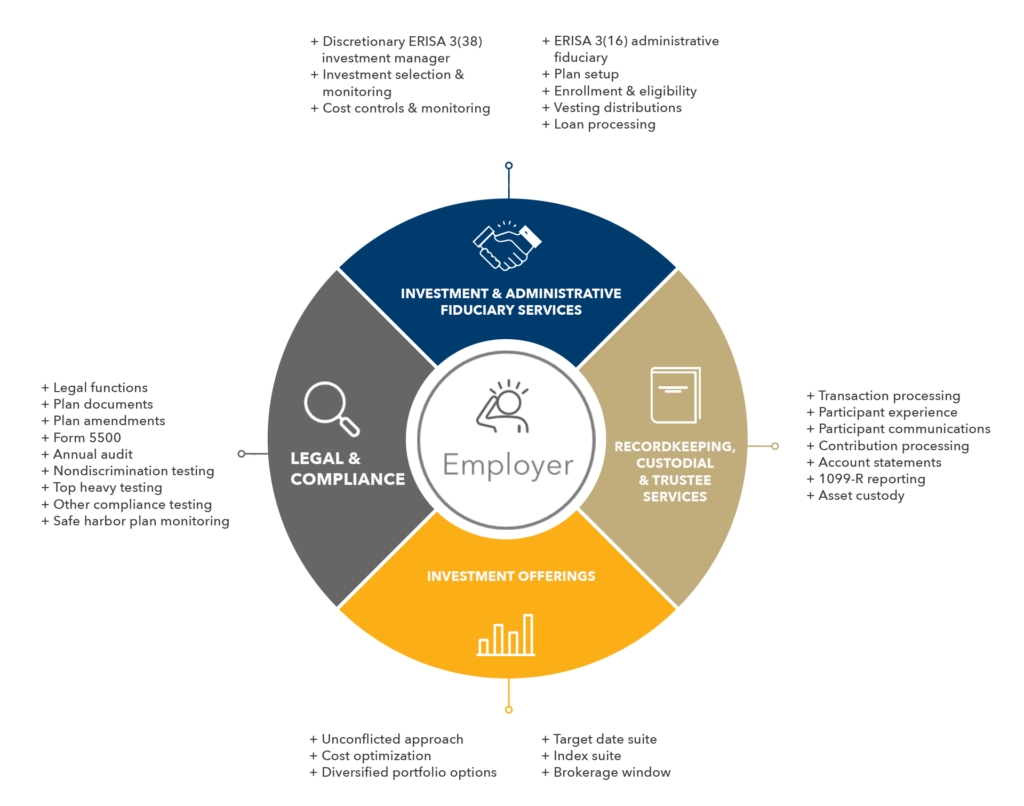

Access provides a series of simple low-cost 401(k) retirement plan PEPs in an unconflicted structure designed to dramatically improve efficiency and reduce administrative and investment costs.

As a complete retirement solution provider, Access provides employers with one point of contact and removes the headaches of offering a 401(k) retirement plan benefit.

We handle it all with a cost efficient, transparent model: